Chip cards are rapidly becoming the industry standard over traditional magstripe cards, and the reasons are not far-fetched. These cards use an embedded microchip instead of the magnetic stripe used in traditional bank cards. This change in bank card technology has several major advantages, which we will discuss in this article. Also, we’ll walk you through the basics of how they work, how they work, and the types of chip cards we have.

What Is a Chip Card?

Chip cards are also known as smart cards, EMV cards, chip and pin cards, chip and signature cards, or integrated circuit cards, among others. It is a type of bank card that uses EMV technology to store data and process transactions. This technology is commonly found in debit cards, credit cards, and prepaid smart cards.

EMV is an acronym for Europay, Mastercard, and Visa, the three companies that created the EMV standard and the first to adopt the technology. EMV chip cards use an integrated circuit chip embedded in the card’s plastic material. This IC chip is actually a tiny computer with a microprocessor, application software, internal memory, and even wireless connectivity in contactless cards. This stores user information and generates a unique code for every transaction, which is, in turn, verified by the financial institution that issued the card or the terminal where the card is used.

The major difference between the integrated circuit chip and the traditional magnetic stripe is that while the magnetic stripe only stores transaction information, EMV cards use codes from a secure vault with keys unique to each EMV card while still storing transaction data. This ensures substantially enhanced security compared to magstripe cards. Also, while magstripe cards require users to swipe the card through the machine, chip cards are inserted into a chip-enabled Automated Teller Machine (ATM) or point-of-sale (POS) machine or hovered in front of the terminal if it is a contactless card.

Where Is the Chip On a Card?

The chips on contact EMV cards are located on the front of the cards, the same side where the card number and expiry date are located. It is located on one side of the card. It is this side that will be inserted into the terminal. On the other hand, contactless cards do not have visible chips since the circuitry is inside the card. Both contact and contactless cards usually have a magnetic stripe on the back to enable card usage if a chip-enabled terminal is unavailable.

How Are Chip Cards Made?

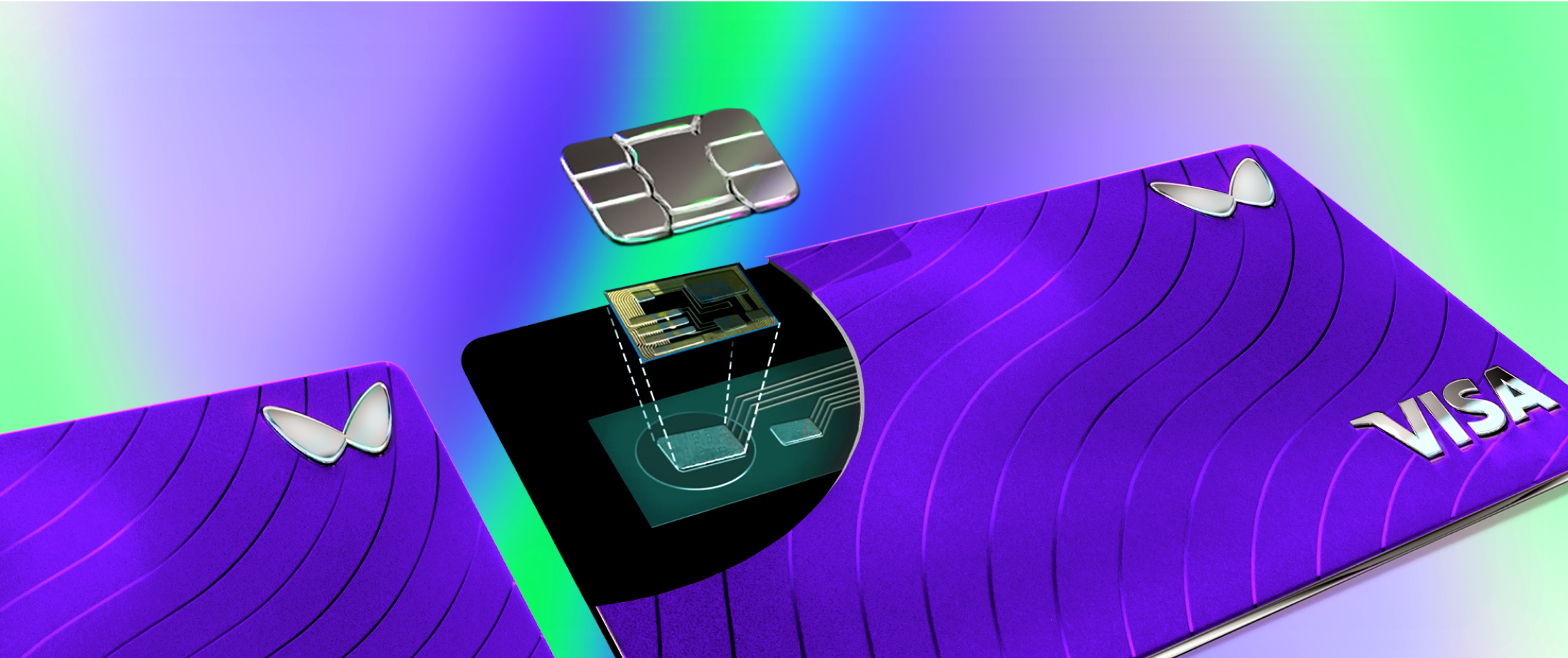

The manufacturing process of chip cards starts with large glass cylinders of extreme purity. Each one of these cylinders weighs about 500 pounds. These are then cut into thousands of wafer-thin slices, serving as the foundation for several integrated circuits. Tiny circuits are then infused on top of the silicon wafers. The wafers are then ground to make them still thinner. Each wafer is then cut with laser saws into the individual IC chips that go into the plastic cards we all use.

The individual chips are bonded electronically to gold or silver contact pads and sealed to keep them safe for consumer use. This part is what we see on our cards, as the actual integrated circuit is located under the metallic plate. They are now inserted into the plastic card with suitable adhesives. The card is then programmed with software to act as a communication link between the chip card and the bank or card terminal.

How Does a Chip Card Work?

Whenever a chip card is inserted in or waved in front of a chip-enabled terminal, the embedded chip generates a unique code for that transaction which is verified by the financial institution that issued the card. This code can only be used once for that single transaction. If the transaction fails or a new transaction is to be processed, a new code is generated, which also can’t be used again by anyone. These codes ensure that chip cards are extremely difficult to compromise since the cards won’t be able to generate the right codes even if they fall into the wrong hands.

The user enters their PIN or gives their signature to give consent to the transaction. The terminal then forwards the cardholder’s data to the merchant or card issuer, who check if the account balance supports the transaction and is then approved by the card-issuing company. If the balance does not support the transaction, the card is rejected by the terminal, and the transaction is not completed.

This is in stark contrast to the magnetic stripe technology used in traditional bank cards. These magnetic strips only store user information such as available account balance, credit limit, and transaction limits where applicable. The information is now supplied to the transaction terminal or card issuer when it is swiped through the card terminal. The information is then used to verify the transaction.

Types of Chip Cards

Chip cards are of two types based on the method of additional security used to confirm transactions. These two types are Chip-And-Signature as well as Chip-And-PIN cards.

Chip-And-Signature Cards: Chip and signature cards offer slightly more security than traditional bank cards with magnetic stripes. They can easily be recognised by the signature that is shown on the back of the card in addition to the other provided information. This signature belongs to the owner of the card and must be provided at the transaction point to verify user identity. The transaction is then approved if the given signature matches that provided on the card. This type of card is less secure than its PIN counterpart because of the relative ease with which signatures can be duplicated.

Chip and signature cards are currently being used in only a few regions, being overshadowed by the more secure chip and PIN cards. As of 2015, they were more common in Mexico, the United States, some parts of South America (including Colombia, Argentina, and Peru), and a few Asian countries such as Thailand, Hong Kong, South Korea, Taiwan, Indonesia, and Singapore). Even in these regions, they are being replaced more and more by the PIN alternative.

Chip-and-PIN cards: This is the most secure chip card type. Instead of requesting a signature for identity authentication, chip and PIN cards use a four-digit Personal Identification Number (PIN). This number is chosen by the cardholder and must be provided before any transaction on the bank card can be completed. They are considerably more secure than chip and signature cards since it is much harder to guess a PIN than it is to forge signatures. For additional security and to discourage guessing, a chip card is rendered ineffective if the PIN is entered incorrectly three times. This, coupled with the virtual impossibility of making counterfeit EMV cards, makes card fraud extremely difficult.

The majority of EMV chip cards are of the chip and PIN type. In fact, they are the only type of chip cards available in other regions of the world apart from the United States, South America, and Asia. They are being used extensively in most European countries (such as the United Kingdom, France, Ireland, Portugal, the Netherlands, and Finland), most African countries (including Nigeria, Kenya, Ghana, Egypt, and South Africa), as well as Iran, Venezuela, Brazil, Sri Lanka, India, Australia, New Zealand, and Canada.

What Countries Use Chip Cards?

In several countries of the world, the only available bank cards are those that use chip card technology. In Europe, where the EMV standard was first adopted, the total card transactions were almost 100% EMV transactions as of 2021. They are also the majority of bank cards used in all regions of the world regions.

The total number of EMV smart cards in circulation worldwide was more than 10.81 billion as of the end of 2020. This was a 10% increase compared to the amount in circulation at the end of the previous year.

The total percentage of EMV transactions around the world from July 2020 to June 2021 is as follows:

- 99.56% for Europe zone 1 with 1.07 billion cards,

- 98.69% for Africa and the Middle East with 339m cards,

- 96.97% for Europe zone 2 with 335million million cards,

- 95.34% for Latin America, Canada, and the Caribbean with 1.02billion cards,

- 82.92% for Asia with 6.88 billion cards, and

- 77.52% for the United States, with 1.16 billion EMV cards in circulation

Globally as of 2020, 66.4% of all issued bank cards worldwide used EMV chip card technology. The transition to chip-based cards is comparatively slow in the United States and Asia, mainly due to high costs, equipment availability, and other factors. But with the latest liability law in the United States, more merchants are switching to chip cards. The law states that the liability of fraud lies with the merchant or the bank that uses the magnetic stripe reader. Therefore, it is no surprise that there is a wave of businesses switching to this technology.

Are Chip Cards More Secure Than Traditional Bank Cards?

Chip cards are decidedly more secure compared to traditional bank cards that use magnetic stripe technology. The EMV technology was developed in the first place to reduce the rate of card fraud which was so rampant in the era of magnetic stripe cards. The technology has proven quite effective, considering the fact that the payment fraud rate has reduced exponentially since the widespread adoption of EMV technology. Between September 2015 and March 2019 alone, there was an 87% drop in card fraud in the United States, according to a report published by Visa in June 2019.

So, how do chip cards bring about increased protection?

Firstly, it is almost impossible to clone chip cards. With magnetic stripe cards, all that was needed to duplicate a card was to pass it through a compromised terminal that reads and copies the information contained on the card. The information is then transferred to another card which can now be used for purchases just like the original card. This process is similar to the one used in duplicating floppy discs or magnetic disc drives. With EMV smartcards, they are faced with a tamper-proof IC chip.

Also, the chip on EMV cards provides more sophisticated authentication than magnetic-stripe cards. They generate unique codes for each transaction compared to the magnetic stripe cards, which only store the information needed to verify transactions. They also make transactions more secure by encrypting user information when used with chip-enabled machines.

Are chip cards fraud-proof?

The short answer is NO. It’s true that they are much more secure than their magstripe alternatives, but this does not mean that they are totally immune to fraud. Some phishing sites pose as legitimate businesses with the sole aim of obtaining sensitive information from users. The information thus obtained can now be used to perform card-not-present transactions. But without your personal data, it’s virtually impossible to make transactions using EMV cards. One important thing to know is that chip cards function as magstripe cards if the magnetic stripe is used instead, which means that user information can be obtained from the cards if it is used at a compromised terminal.

What Equipment Is Needed to Accept EMV Chip Cards?

It’s quite easy to get started with EMV chip cards. The only requirement for merchants is a machine that can read from the integrated circuit found in chip cards. Most of these EMV readers also come with a magnetic stripe slot to take advantage of the strip that is used as an alternative to the IC chip. Since there is a trend towards contactless cards, it is very advantageous if the machine supports NFC.

How are EMV chip card transactions processed?

EMV cards use Dynamic Data Authentication (DDA), a protocol for checking chip card legitimacy. It’s an offline method that checks the preloaded keys on the card with the complementary keys from the terminal. The cardholder then enters the corresponding PIN or signature to verify the user’s identity. The user can now proceed to perform whatever transactions they wish. If another transaction is to be performed, the process is repeated all over again.

Benefits of Chip Cards

Chip cards offer several advantages over magnetic stripe cards. Some of these are given below:

✅ Improved Security: As mentioned several times before, the security of chip cards is almost fail-proof. The strong cryptography and tokenisation of chip cards ensure increased security against payment fraud. These make chip cards almost fully effective against card-present fraud. Also, all card transactions are monitored by the issuing banks so that the right measures can be taken if suspicious activities are performed.

✅ Increased Card Spending: The convenience of contactless chip cards makes users perform more transactions on their cards. Studies show that adding the contactless ability to chip cards actually generated a significant increase in transactions on the same cards.

✅ Global Interoperability of The EMV Standard: EMV is the worldwide standard for card payments. This is majorly due to their reliability and convenience. In parts of Europe and Canada, the EMV’s market penetration is almost 100%. Today, it is almost impossible to perform transactions with magnetic stripe cards if you travel to some parts of the world.

✅ Strengthened Customer Relationships: The increased security of chip cards increases customer trust in the issuing company. The convenience and international acceptance also generate positive user feedback. This, in turn, improves customer relations considerably.

✅ Mobile Transactions: EMV cards have improved integration with mobile devices and online processing. Contact EMV cards are used by inserting the card into a chip-enabled terminal that verifies the transaction.

Contactless chip cards are waved in front of or tapped against the NFC-enabled terminal. Contactless cards might or might not require PIN authentication. They are more secure, faster, and future-proof.

They can also be integrated with a mobile device which can now be used for transactions. A one-time password (OTP) is sent to the registered device in order to authenticate the transaction. An NFC-enabled device can be waved in front of the terminal or tapped on it just like a contactless EMV card.

Below are some frequently asked questions about EMV chip cards:

Should Customers Switch to EMV Chip Technology?

Absolutely! It is strongly recommended that customers switch to chip cards due to the safety and other benefits they offer. This advice is also applicable to merchants who wish to improve their businesses.

How Do I Get a Chip and PIN Card?

You can request your own chip card from the bank or other financial institution that issued your previous card. You can also get it from companies such as Wallester, which manufactures EMV cards for consumers and businesses alike. The new card might come with your previous account number, but the expiry date and CVV will be different.

How To Use a Card with a Chip?

Chip cards only require you to insert your card into the terminal if it’s a contact card. The card stays in until the transaction is completed. Contactless cards can be tapped on or waved near the terminal to carry out transactions.

How Can I Protect Myself from Chip Card Fraud?

The card PIN should be kept as personal as possible and should never be disclosed to anybody, even bank attendants. If the PIN is required, you’ll be asked to enter it by yourself.

Also, be extremely careful when giving out your information online so you don’t fall victim to phishing scams. Make sure you only enter your details on trusted sites. If you have to make an online transaction, your bank will contact you in order to verify the transaction.

EMV technology is the way to go for secure and convenient transactions. If you have any other questions or inquiries, you can visit Wallester.com.

We would be delighted to meet with you and discuss your business case, and explore how we can be of assistance.

Don’t hesitate to reach out to us through this contact form.